The Ultimate Guide to Retirement Planning in 2025: Protect Your Future Against America's New Realities

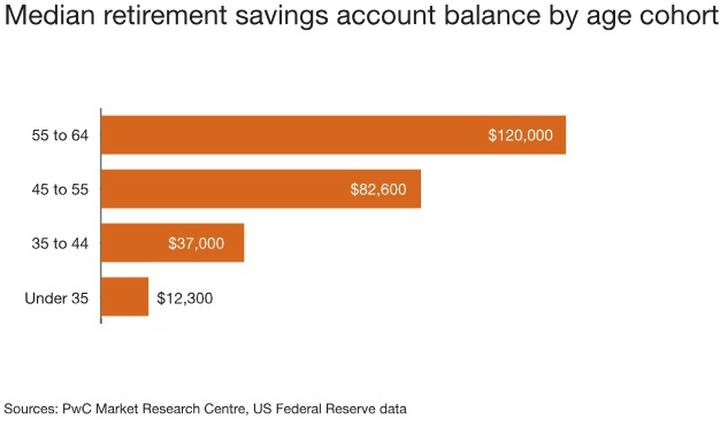

Why Time Is Running Out for Gen X & Millennials

The average 65-year-old couple will need $413,000 just to cover medical costs in retirement—and that's before accounting for 3.2% annual inflation gnawing at your savings. With Social Security's trust fund projected to deplete by 2033, leaving only 79% of promised benefits, strategic planning is no longer optional.

Step 1: Calculate Your REAL Retirement Number

Traditional "80% income replacement" rules fail in 2025's climate. Use this three-dimensional approach:

Longevity Shock

- Check your personalized life expectancy at Social Security’s Life Expectancy Calculator

- Plan for 30+ years of retirement if born after 1970 (CDC data shows 1 in 3 65-year-olds will reach 90)

Stealth Inflation

- Use the BLS Inflation Calculator to see how $100 today becomes $55 in 2045 at 3% inflation

Geographic Arbitrage

- Compare costs: Retiring in Nashville vs. Tampa could save $1,200/month on housing

- Explore tax havens: 9 states including Florida and Texas have no income tax on retirement withdrawals

Case Study: Mark, 45 (Denver IT manager), discovered moving to Knoxville, TN would reduce his target savings from $2.8M to $2.1M through lower property taxes and healthcare costs.

Step 2: Exploit 2025 Tax Code Changes

With Trump-era tax cuts sunsetting in 2025, act now:

| Strategy | Action Item | Deadline |

|---|---|---|

| Roth Conversion Ladder | Convert traditional IRA funds during 24% tax bracket (projected to jump to 28% in 2026) | Dec 31, 2025 |

| Mega Backdoor Roth | Contribute after-tax 401(k) up to $43,500 (2025 limit) if your plan allows in-service rollovers | Ongoing |

| HSA Triple Tax Advantage | Max out $4,300 individual/$8,300 family contributions (2025 limits), invest in low-cost index funds | Dec 31, 2025 |

Pro Tip: Use tax calculators to model different scenarios.

Step 3: Build a Crash-Proof Portfolio

The 60/40 stock-bond split is dead. Modern allocation for 2025 retirees:

Defensive Foundation (50%)

- TIPS (Treasury Inflation-Protected Securities): Ladder maturities using government platforms

- Healthcare REITs: Welltower (WELL) yields 5.3% with 97% occupancy in senior housing

Growth Engine (30%)

- Low-volatility ETFs: Schwab U.S. Dividend Equity (SCHD) or Invesco S&P 500 Low Volatility (SPLV)

- Robo-Advisor Hybrid: Vanguard Digital Advisor (0.15% fee) auto-rebalances during market shocks

Longevity Hedge (20%)

- QLAC (Qualified Longevity Annuity Contract): Defer $200,000 (max) until age 85 for guaranteed income

- Bitcoin ETF Allocation: BlackRock’s IBIT offers 0.12% expense ratio as digital gold hedge

Red Flag: Avoid variable annuities with fees over 2%—they erode 45% of returns over 20 years.

Step 4: Outsmart Medicare’s Hidden Traps

Avoid these 3 costly mistakes:

IRMAA Surcharge

- If your modified AGI exceeds $103k (single)/$206k (joint), you’ll pay $578/month extra for Part B and D

- Solution: Use Roth conversions strategically to stay below thresholds

Part D "Donut Hole"

- Once drug costs hit $4,660 (2025), you pay 25% until $7,400. Use pharmacy discount programs to bypass formulary restrictions

Medigap Timing

- Enroll in Plan G within 6 months of turning 65 to avoid medical underwriting. Average savings: $1,200/year vs. Advantage Plans

Critical: Bookmark Medicare.gov’s Plan Finder for annual coverage reviews.

Step 5: Create Guaranteed Lifetime Income

Forget the 4% Rule. Implement Yale-endorsed "Time Segmentation":

| Bucket | Timeframe | Vehicles |

|---|---|---|

| Liquidity | 0-2 Years | High-yield savings (Ally Bank 4.25% APY) |

| Stability | 3-7 Years | CD Ladder (Discover 5-year CD at 4.7%) |

| Growth | 8-15 Years | Vanguard Target Date 2040 (VTTHX) |

| Longevity | 16+ Years | Immediate annuity quotes |

Success Story: Linda, 58, combined a $300k QLAC with rental income from her Phoenix condo to generate $4,800/month inflation-adjusted cash flow.

Step 6: Bulletproof Your Legacy

The SECURE Act 2.0 changed inheritance rules:

- Non-Spouse Beneficiaries must drain inherited IRAs within 10 years (exception: chronically ill heirs)

- Solution: Establish a Charitable Remainder Trust (CRT) to stretch distributions over 20 years

Use estate planning tools to create legally valid documents.

Your 90-Day Action Plan

- Week 1: Check Social Security statement

- Month 1: Schedule a "Medicare Preview" consultation

- Quarter 1: Rebalance portfolio using advisory services

- Day 180: Complete beneficiary updates on all accounts

Final Reality Check: The average American spends 18 years in retirement but only 18 hours planning for it. By implementing these evidence-based strategies, you’re not just saving money—you’re buying freedom. Start today, because 2025’s challenges demand your preparation now.