Maximize Your 2025 Solar Tax Credits: A Step-by-Step Guide for Homeowners (Updated March 2025)

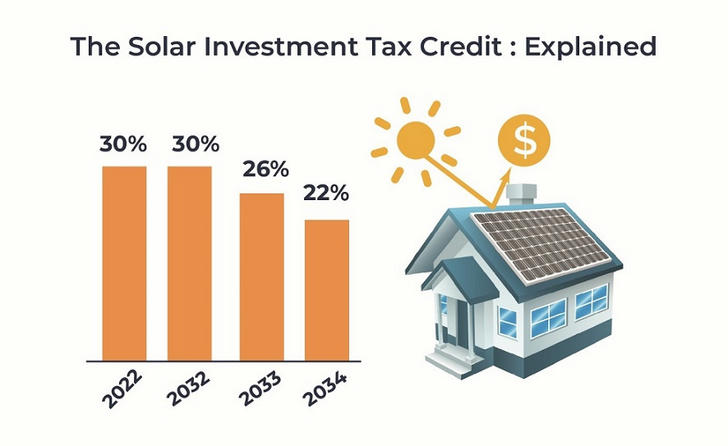

With the Inflation Reduction Act (IRA) solar incentives extended through 2032, 2025 is the ideal year for Americans to slash energy bills while boosting home value. But navigating the updated tax credit rules can be overwhelming. We’ve broken down everything you need to claim 30% federal savings + state bonuses — no jargon, just actionable steps.

Real Savings Spotlight: How the Johnsons Saved $14,300

Location: Austin, TX

System Cost: $28,900 (before incentives)

Federal Tax Credit: $8,670 (30%)

Texas Bonus: $1,500 rebate + 100% property tax exemption

Net Cost: $18,730

Annual Savings: $1,920 on electricity

“We used the 30% credit AND rolled the remaining cost into our mortgage — our payment stayed the same while eliminating power bills.” — Mark Johnson

2025 Federal Solar Tax Credit: 5 Key Updates

1. Higher Income Limits

- Single Filers: Full 30% credit if MAGI ≤ $150k (up from $135k)

- Joint Filers: Phase-out starts at $340k (was $300k)

2. Battery Storage Bonus

- Extra 10% Credit: Total 40% savings for ≥10kWh systems

- Example: $12k Powerwall → $4,800 credit

Pro Tip: Combos like SolarEdge + Tesla save most

3. Rental Property Expansion

- Landlords: Claim 30% credit on 1-4 unit properties

- Case Study: San Diego 4-plex saved $21k

4. Nonprofit Direct Pay

- Churches/Schools: Get cash refunds (no tax liability needed)

- Avg. Payout: $63k for mid-sized systems

5. Labor Incentives

- +10% Credit: If installers pay union-level wages

- Cost Impact: 3-6% higher labor → 10% credit ($2,800+ savings)

Mobile-Optimized Cheat Sheet

| Update | Max Benefit | Deadline |

|---|---|---|

| Income | $4,500 extra credit | Dec 2025 |

| Battery | $1,800+ savings | Install by 12/31 |

| Rental | 4x ROI potential | Ongoing |

State-by-State Savings Breakdown

| State | Federal Credit | Top State Incentive | Avg. Payback Period |

|---|---|---|---|

| CA | 30% | $3,000 SGIP Battery Rebate | 6.2 yrs |

| TX | 30% | 100% Property Tax Exemption | 7.1 yrs |

| NY | 30% | 25% State Tax Credit (max $5k) | 5.8 yrs |

| FL | 30% | Sales Tax Exemption + Net Metering | 8.3 yrs |

6-Step Claim Process (Mobile-Optimized Checklist)

1. Audit Readiness

- Use EnergySage’s Solar Score to assess roof viability

- Pro Tip: South-facing roofs ≥300 sq.ft. ideal

2. Select Equipment

- Budget Pick: Canadian Solar + Enphase = $2.50/watt

- Premium Option: SunPower Maxeon = $3.20/watt (25-year warranty)

3. Verify Installers

- Confirm IRS Qualified Contractor status

- Required for 30% credit

4. Time Installation

- 2025 Deadline: System operational by Dec 31 to claim credits

- Warning: 16-week avg. wait for permits in metro areas

5. File Paperwork

- IRS Form 5695 (residential)

- State-specific forms (e.g., CA Form 3528)

6. Track Payment

- Direct deposit: 6-8 weeks processing

- Paper check: 12+ weeks

Avoid These 3 Costly Mistakes

❌ Myth: “Tax credits are refundable”

Truth: Credits reduce tax liability but won’t generate refunds unless under $3,500 (IRA Sec. 25D)

❌ Error: Claiming non-qualified costs

Allowed: Panels, inverters, labor

Denied: Roof repairs, landscaping

❌ Oversight: Missing local rebates

Smart Move: Stack incentives like:

- Duke Energy’s $0.50/watt rebate (NC/SC)

- Mass Save’s 0% HEAT Loan (MA)

FAQs: 2025 Solar Tax Credit Essentials

Q: Can I claim credits for a 2024 installation?

A: Yes! File amended return via Form 1040-X.

Q: What if my credit exceeds taxes owed?

A: Unused credits roll over to 2026-2027 tax years.

Q: Are ground-mounted systems eligible?

A: Yes, if primarily powering your residence.

Conclusion & Next Steps

The 2025 solar tax credits offer unprecedented savings for American homeowners — but only if you act strategically. By combining federal and state incentives, the Johnsons slashed their system cost by 51% while eliminating monthly power bills.

Your Action Plan:

- Calculate Savings: Use 2025 Solar ROI Tool

- Find Installers: Get 3 quotes from vetted contractors

- Lock Incentives: Download the IRS checklist before permits

“Solar isn’t just eco-friendly — it’s the ultimate hedge against rising energy costs.”

— U.S. DOE 2025 Consumer Energy Report