Clean Energy Investment: Powering the Future While Generating Profits

Clean energy investment is becoming increasingly vital as the world transitions to more sustainable energy sources[4]. This shift is driven by growing concerns about climate change, stricter government regulations, and increasing demand for renewable energy[2]. Investment in clean energy presents significant opportunities for businesses, governments, and individual investors[4].

What is Clean Energy?

Clean energy is derived from renewable sources that produce minimal or no greenhouse gas emissions[4]. Common sources include solar, wind, hydropower, geothermal, and biomass[2][4].

Why Invest in Clean Energy?

Growing Demand: As awareness of climate change increases, the demand for clean energy technologies and solutions surges[4].

Government Support: Many governments offer incentives, tax credits, and subsidies for clean energy projects, enhancing profitability for investors[4]. For example, the U.S. federal tax credits and the European Union’s Green Deal provide long-term support[4].

Sustainability Goals: Clean energy investments align with corporate environmental, social, and governance (ESG) goals, appealing to socially conscious investors and enhancing corporate reputation[4].

Types of Clean Energy Investments

Stocks: Investors can purchase shares in clean energy companies involved in production, distribution, and technology development, such as NextEra Energy and Vestas Wind Systems[4].

ETFs: Clean energy exchange-traded funds (ETFs) offer diversified exposure to the renewable energy sector, such as iShares Global Clean Energy ETF (ICLN) and Invesco Solar ETF (TAN)[4].

Green Bonds: These debt securities finance environmentally beneficial projects, providing a steady income stream while supporting clean energy initiatives[4].

Direct Investments: Investors can directly finance projects like solar or wind farms, potentially earning returns from energy production and distribution[4].

Benefits of Clean Energy Investment

Long-Term Financial Growth: The renewable energy sector is poised for long-term growth, with significant expansion expected in solar, wind, and energy storage[4].

Environmental Impact: Clean energy reduces carbon emissions, improves air and water quality, and promotes natural resource preservation[4].

Diversification: Clean energy investments can diversify portfolios and hedge against the volatility of traditional energy markets[4].

Challenges in Clean Energy Investment

Initial Costs: Some projects require significant upfront capital, and investors must be prepared for potential financial risks[4].

Market Volatility: Clean energy stocks can experience volatility due to changes in government policy, technological breakthroughs, or competition[4].

Technological Uncertainty: Not all emerging clean energy solutions will succeed, requiring investors to carefully evaluate long-term potential and technological risks[4].

Key Trends Shaping Clean Energy in 2025

Industrial Policy: Governments are shaping energy transition policies to support economic and industrial ambitions, prioritizing job creation and energy security[5].

AI Energy Demand: The increasing energy demands of AI and data centers are driving the need for reliable, clean energy sources[1][5]. Data centers could drive approximately 44 GW of additional demand by 2030[1].

Nuclear Energy: Attitudes toward nuclear energy are shifting, with many viewing it as integral to the energy transition[5].

R&D and Innovation: Continuous innovation in the clean energy sector is reflected in increasing investment and public budget allocations for research and development[5].

Investment Opportunities in Clean Energy

Solar and Wind Energy: These are among the fastest-growing segments in clean tech. Investments in these sectors accounted for 70% of the $755 billion invested in the energy transition in 2021[2].

Clean Energy Supply Chains: Investment in clean energy supply chains, including equipment factories and battery-metal production assets, reached $140 billion in 2024[3].

Decarbonization: Opportunities exist in clean tech firms, electric utilities transitioning from fossil fuels, and oil and gas companies investing in cleaner production[4].

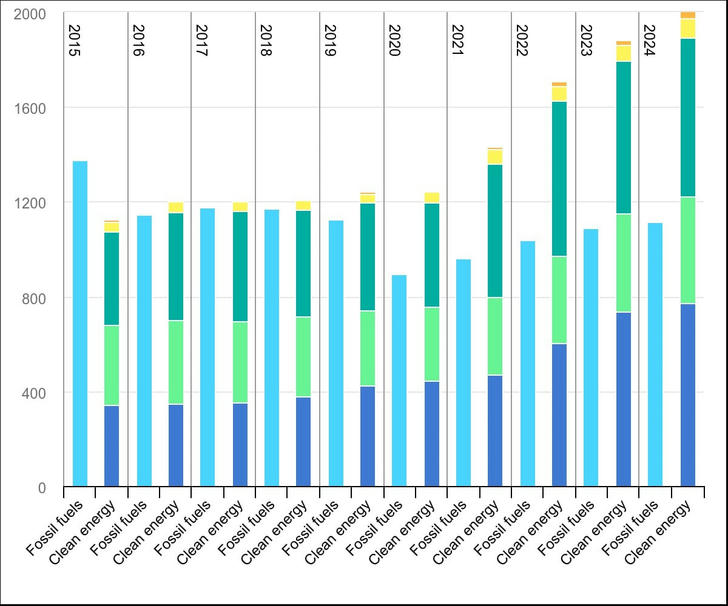

Energy Transition: Despite hitting a new high in 2024, energy transition investment still falls short of what is needed to reach net zero by 2050[3]. Annual clean spending needs to average $5.6 trillion between 2025 and 2030, a 168% increase from 2024[3].

Clean Tech on the Rise

Clean technology is on the rise, driven by the rising global demand for sustainability and a supportive regulatory environment[2]. Investments in clean energy could rise to $6 trillion annually by 2030[2]. The global clean energy market is projected to reach $1.9 trillion by 2030, growing at a CAGR of 10.2% from 2020[2].

Looking Ahead to 2025

Momentum for clean energy may continue, pending new policy approaches. Cleantech manufacturing, AI, and carbon industries will likely continue to drive renewables deployment[1]. Domestic supply chains and AI acceleration of operational and technological innovation could provide additional advantages[1].

Related Website:

[1] https://www2.deloitte.com/us/en/insights/industry/renewable-energy/renewable-energy-industry-outlook.html?id=us%3A2el%3A3pr%3A2019re%3Aawa%3Aer%3A121218

[2] https://icg.co/renewable-energy-investment-opportunities-2024/

[3] https://assets.bbhub.io/professional/sites/24/951623_BNEF-Energy-Transition-Trends-2025-Abridged.pdf

[4] https://www.morganstanley.com/articles/decarbonization-renewable-energy-investment-ideas

[5] https://www.weforum.org/stories/2025/01/4-key-trends-to-watch-in-clean-energy-technology-in-2025/

[6] https://ieefa.org/articles/renewable-supply-chain-presents-investment-opportunities-seven-asian-markets-could-exceed

[7] https://www.netzeroinvestor.net/news-and-views/what-are-the-best-energy-transition-investment-opportunities-in-2025

[8] https://www.iea.org/reports/world-energy-investment-2023/overview-and-key-findings